Overview

Public Sector at a Glance

Operations

Investment for future generations in Sub-Saharan Africa

Seeking funding from BADEA’s public sector window is a unique opportunity to finance solutions to the most pressing development and climate issues to empower local communities in building greater resilience in an ever-changing world.

Contact:

For enquiries, please contact: badea@badea.org

Key Benefits

A solid Arab-African expertise and network

Our proven 50-year track record leveraging Arab funds for the benefit of African economies for greater impact. For each US dollar invested by BADEA, we channel 4 additional dollars from partners

A strong rating at the service of Africa’s development

Our passion to channel additional resources towards the continent to finance critical projects, changing lives at a competitive rate

Impact investing focus

Our business approach focused on empowering communities, driving inclusive growth and taking care of our planet

A solution-driven green mindset

Our efforts to optimize green and sustainable components of projects by adding a layer of solar energy to power schools in remote areas, for example.

A strategic long-term development focus

Our vast experience funding strategic impactful projects with long tenure maturities at highly concessional lending terms

Flexibility

Our tailored solutions, offering a foreign currency mix (USD / EUR)

Pragmatically turning dreams into reality

Our integrated capacity development approach offers non-refundable grants to finance – from our very own book – key feasibility studies demonstrating the vital need of each project before offering loans

Transfer of knowledge and expertise approach

As a financial instrument at the service of the Arab-African solidarity, we value knowledge and expertise transfer by supporting clients with top-notch Arab expert capacity development services

Key Sectors We Support

- Social Infrastructure (Education and Health))

- Powering Africa (Energy)

- Food Security (Agriculture Value Chains)

- SMEs and Entrepreneurship

- Finance

- Digital Economy (ICT)

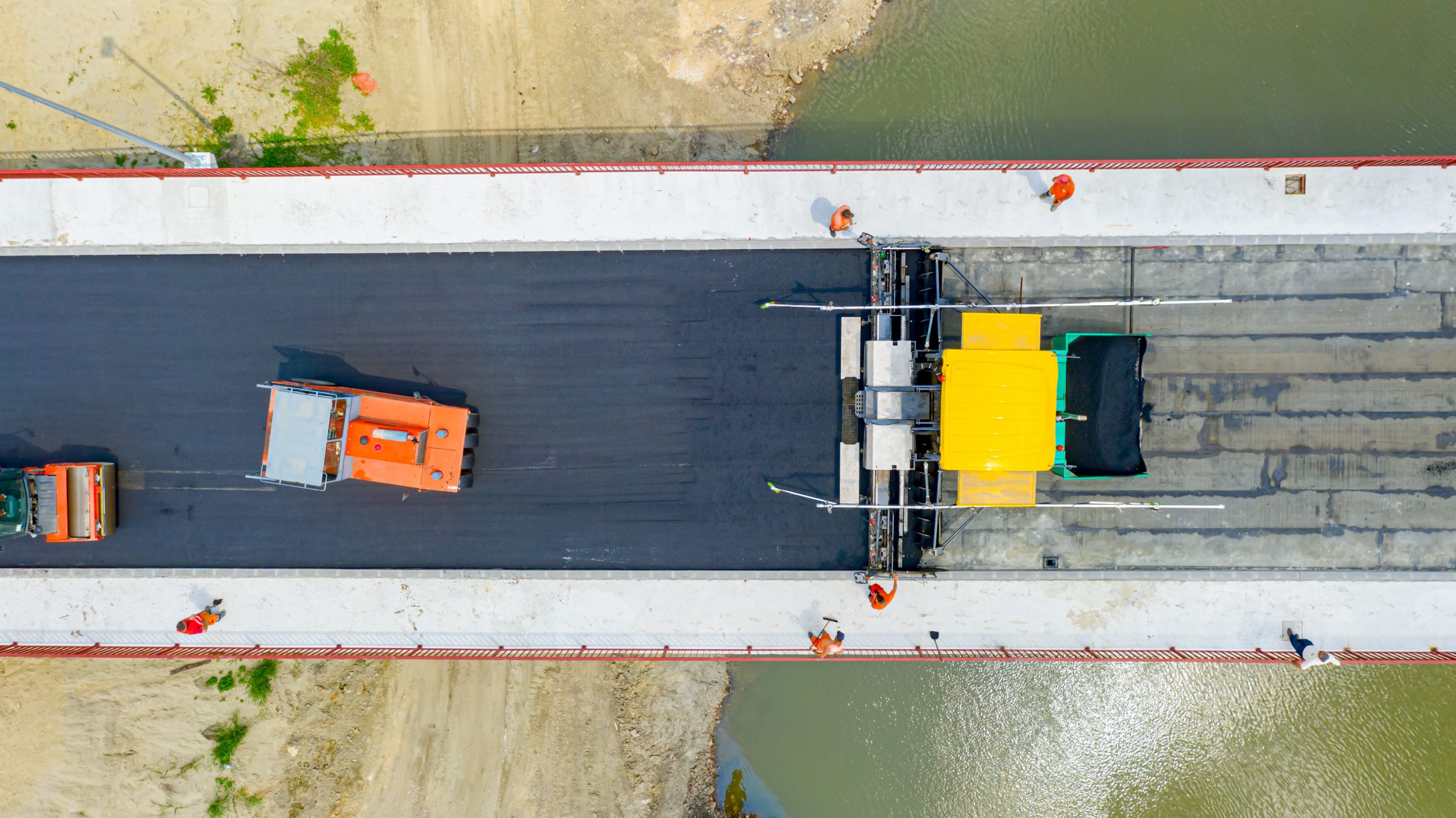

- Sustainable and Resilient Transportation (Roads, Rails, Airports, Seaports)

- Sustainable and Connected Cities (Urban Development)

Financial Instruments

- Sovereign Loans

- Lines of Credit to Financial Institutions

- Non-refundable Grants

- Blended Finance

Main Lending Criteria

- Public Sector Loans

Ticket size: variable (specific to the industry and nature of the project)

Tenor: 15-25 years

Grace periods: projects typically benefit from grace periods of 3 years up to 7 years

Pricing: concessional terms lending currencies: USD and EUR

- Non refundable grants

Please, visit the relevant section fully dedicated to grants, here.

Public sector project cycle at a Glance

- STEP A: Official requests for transactions under our public sector window are traditionally initiated by relevant ministries and governments.

- STEP B: Internal Review and Approval: the requests are thoroughly reviewed by our experts to ensure positive impact on communities and the wider environment, among others.

- STEP C: Signature after finalizing the legal terms of approved transactions, stakeholders officially sign the loan agreement.

- STEP D: Effectiveness / Financial Close The loan takes effect once certain conditions agreed to be necessary to the first disbursement are fully met.

- STEP E: Disbursement and Follow-Up: BADEA never gives funds to governments or ministries directly. Instead, the Bank pays the invoices of relevant stakeholders, such as subcontractors, working on a specific project. such as subcontractors. BADEA monitors the project to ensure the highest execution standards and best practices for follow-up.